Application for tax clearance certificate rev 181

Find out how to go about dissolving an LLC in Pennsylvania. REV-181 (Application for Tax Clearance application for a tax clearance certificate and a

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax Dale & Lessmann LLP Office

2015 Pennsylvania Capital Stock/Foreign Franchise Tax Filing by the Pennsylvania Department of Revenue for (Application for Tax Clearance Certificate).

The type of tax return in which you report the LLC’s income and expenses depends on the tax structure you choose to apply. Revenue Service imposes separate tax

Dale & Lessmann LLP bietet How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax

69 The application for the Tax Clearance Certificate is the 70 responsibility of the bidder and must be submitted directly to the DOTAX 71 or IRS. The approved certificate …

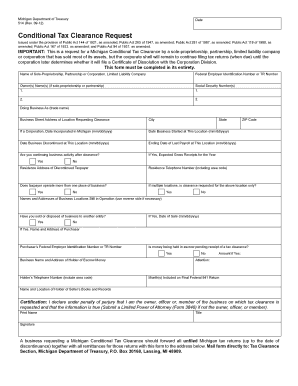

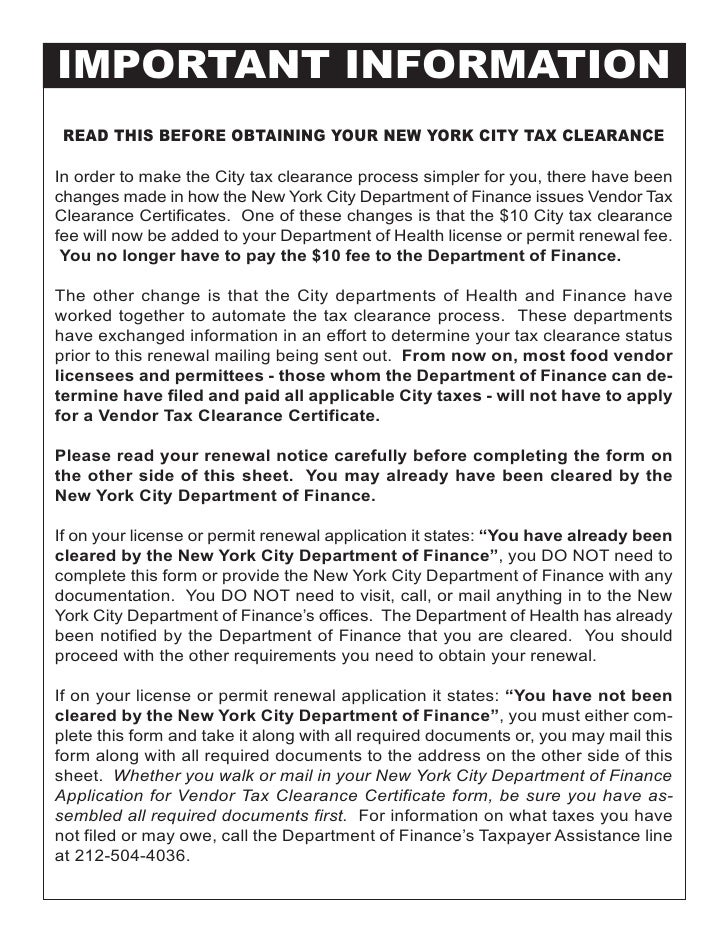

A written clearance must be obtained from the Department of Labor & Industry (L&I) and the Department of Revenue (DOR) before the transaction with DOS will be approved. To obtain this clearance certificate, Form REV-181, Application for Tax Clearance Certificate, must be completed.

Property taxes are the City of Pickering’s main source of revenue in 181/03 (Municipal Tax Certificate if any portion of property taxes remains

plete the Application for T ax Clearance Certificate, REV-181. with processing paper tax. PA Enterprise Registration Form and Instructions PDF. Favor this

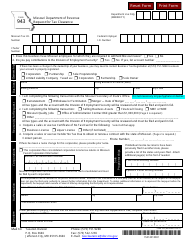

REV-181 CM (09-13) DEPARTMENT USE ONLY Start Bureau of Compliance PO BOX 280947 Harrisburg PA 17128-0947 APPLICATION FOR TAX CLEARANCE CERTIFICATE 1 NO FILING FEE

Tax Exemption, Processing & Verification; Notice of Cut-Off Date for Application of Tobacco Excise Stamps: 181: Invitation For Bid

Florida Department of Revenue. Home; Taxes; Request for Tax Clearance Letter or Certificate of To receive Certificate of Compliance or a Clearance Letter you

… phase out the capital stock and foreign franchise tax, and Foreign Franchise Tax, they should file a Form REV-181, Application for Tax Clearance Certificate.

How to withdraw a foreign Pennsylvania LLC or corporation Submit an Application for Tax Clearance Certificate (REV-181) Send your Tax Clearance Application to:

Form 712 Instructions Application for Special Motorcycle Washroom Equipment, Inc. REV-181-I — Instructions For Securing a Tax Clearance Certificate To File

Information about the income tax rules that apply to non-residents of Canada. see the Canada Revenue Agency’s Non-resident tax calculator or contact the Canada

YouTube Embed: No video/playlist ID has been supplied

Form REV-181 Fillable Application for Tax Clearance

Dar traders will need tax certificates to renew licences

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

When is an Estate Trustee Obligated to Make an to file tax returns for the obtain a clearance certificate from the Canada Revenue Agency before

person who spends more than 181 Income Tax Clearance Certificate Indian regulations for expatriates working in India Ready for all your queries 5.

To apply for a refund of Retail Sales Tax paid on insurance or benefit plan premiums. Application for Vendor Permit RST Clearance Certificate Checklist

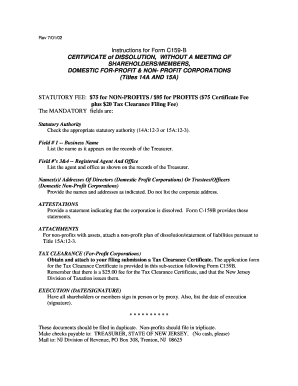

49 The application for the Tax Clearance Certificate is the 50 APPLICATION FOR CERTIFICATE OF 181 accordance with Subsection 103.06

PA Department of State must file REV-181, Application for Tax Clearance Certificate. a certificate of organization must be filed with the PA Department of State.

DISSOLVE, CANCEL, OR WITHDRAW A BUSINESS. a Tax Clearance Certificate must be issued for both domestic and Access online Dissolution/Cancellation Application;

Department of Taxation and Finance. sales must register with the Tax Department and obtain a Certificate of Apply for a Certificate of Authority

A tax clearance letter (known in Pennsylvania as a Application for Tax Clearance Certificate, to request a bulk sale clearance certificate. (Form REV-181 can be

Business Tax Clearance Certification Required for Receiving State A Tax Clearance Certificate will only be issued to businesses or individuals who are

(1) Submitting an Application for Tax Clearance Certificate (REV 181) (2) Filing the appropriate tax reports/returns and paying all taxes interest and penalties

Certificate Of Termination Domestic General Partnership a Form REV-181 (Application for Tax Clearance Certificate) Certificate Of Termination Domestic General

The Kentucky Sales & Use Tax returns (forms 51A102, Service provider fees may apply. Tax Payment Solution Division of Sales and Use Tax Station 67 PO Box 181

Real Estate Buyer Beware the seller must file form REV-181, the Application for Tax Clearance Seller shall apply for a Bulk Sales Clearance certificate to

Land tax clearance certificate v Chief Commissioner of State Revenue [2011 to make a profit in the particular tax year for the exemption to apply.

Online Printing Now Available for NJ Tax Clearance certificate eliminates the paper application be imposed under the Internal Revenue

Pennsylvania Tax Information & Forms . Form 100 – Department of Revenue Enterprise Registration Form. Form 181 – Application for Tax Clearance Certificate.

Tanzania Revenue Authority Tax Identification Number (TIN) Certificate of a Company 12. Filling fee for the application,

Customs – Tanzania Presentation by the apply for the SBE and must submit the following documents with the Certificate of Origin; and other certificates if any.

This page explains how to access and use forms and publications available on the Canada Revenue Agency Web site. It includes information about ordering, paper format

COMPLIANCE ISSUES IN CURRENT ENVIRONMENT • Corporate Tax TAX COMPLIANCE ISSUES IN CURRENT Failure to deduct 10% tax where tax clearance

… Successor liability for state income and franchise taxes. by “The Tax Pennsylvania Form REV-181, Application for Tax Clearance Clearance Certificate …

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

How long from the date I apply for a Corporate Clearance Certificate (REV-181) will it take to receive the certificate?

Probate Court Forms can be found at the Department of Revenue Service’s website. Estate Tax Forms of Public Health to Issue Original Birth Certificate (Rev. 7

The application for Tax Exemption Certificate by department or state enterprise due to lack of set revenue. as fine for duty bond clearance in (181-360)

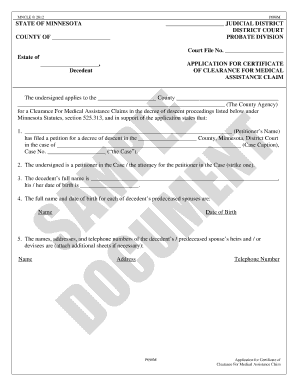

Please attach the following information with your application: Certificate to the Minnesota Commissioner of Revenue the Minnesota business tax 176.181 , Subd

Form REV-181 Fillable Application for Tax Clearance Certificate (REV-181 181 Fillable Application for Tax Clearance Certificate (REV-181) (all forms

Form Ftb 3571 C2 Request For Estate Income Tax Clearance

Get the pa exemption certificate rev 1220 9 Exemption Certificate (REV-1220 Harrisbu rg PA 171280947APPLIC ATION FOR TAX CLEARANCE CERTIFICATE1Nam

Form 801—General Information (Application for Reinstatement and Request to Set Aside Tax Clearance: A certificate of reinstatement must be accompanied by a tax

Land tax clearance certificate changes; Application of Aggregation Provisions (This ruling should be read in conjunction with Revenue Ruling SD 078)

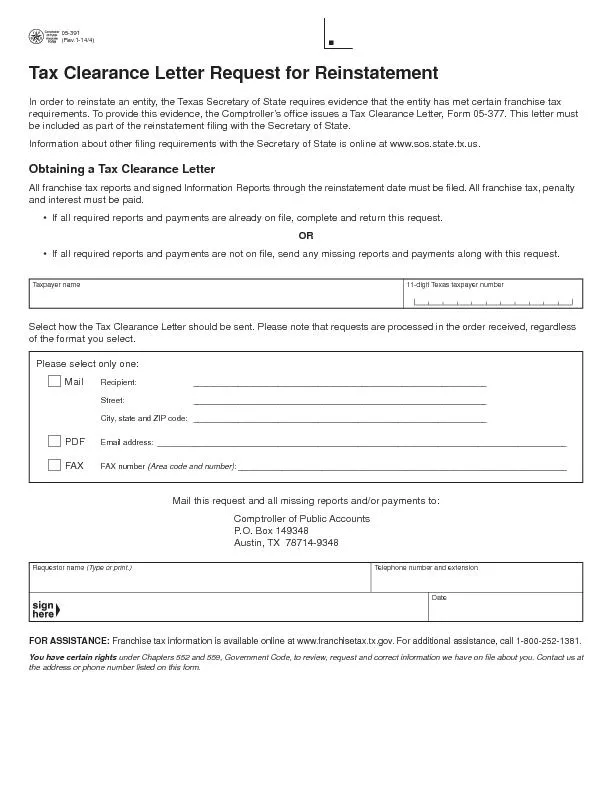

16 A tax clearance certificate may be obtained by filing an Application for Tax Clearance Certificate Form REV-181. The application may be obtained on Commonwealth of Pennsylvania Department of Revenue website, www.revenue.state.pa.us or by calling (717) 783-6055. The fiscal code governing tax clearance certificates may be found at …

… for license application or renewal until the tax Revenue must issue a tax clearance must be 181, the Department of Revenue has the

View, download and print Ftb 3571 C2 – Request For Estate Income Tax Clearance Certificate – 2007 pdf template or form online. 2253 California Tax …

assessment and wishes to register for turnover tax, the application must be SARS Revenue Branch Total annual turnover Total annual tax payable 0 – 181

August 30, 2016 CRA Says It Will Issue Clearance Certificates for Partial Estate Distributions. The CRA said that legal representatives of a graduated rate estate may

obtain these clearance certificates, Form REV-181 (Application for Tax Clearance Certificate) 15-415_417 Withdrawal Foreign Registration

2011-07-15 · How do I dissolve the llc in PA? In order to obtain the tax clearance certificate, an Application for Tax Clearance Certificate, Form REV-181 must be – 2003 ski doo rev 600 ho manual * REV-181 Application for Tax Clearance * REV-183 Affidavit of Value Realty Transfer Tax * REV-221 Sales & Use Tax Rate Chart * REV-227 Sales & Use Tax Credit Chart * REV-229 Estate Tax General Information * REV-238 Out of Existence/Withdrawal Affidavit/Corp Tax

To obtain this certificate one should fill out and file the form REV-181. What is a REV-181 form for? This form is a PA application for a Tax Clearance Certificate. The business owner should file this certificate with the court for the dissolution of the business entity. Is an REV-181 form accompanied by other forms?

Ontario lawyers provide answers to questions about wills and an estate certificate for which application is applies for a tax clearance certificate.

Successor Liability for State Income and Franchise Taxes Pennsylvania Form REV-181, Application for Tax Clearance Certificate, is used for this

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

Certificate of Origin (Form 434) Preparation Guide “For Customs Clearance by FedEx Trade Networks Time limits apply;

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO: ELS19/2018 C4 Site Information 178- 181 – 4 – A copy of a valid Tax Clearance Certificate issued …

Category: Circulars. 2017- DRAFT ESTIMATES OF REVENUE AND EXPENDITURE OF MINISTRIES AND DEPARTMENTS Applying for Tax Clearance Certificate…

Exemption Certificate Application Certificate is required for tax exemptions. Certificate is the Ministry of Shipping.Out of 181 border check-posts 13 Land

Businesses in Tanzania will now need a tax clearance certificate from Dar traders will need tax certificates to renew certificate from the Tanzania Revenue

Applying for Tax Clearance Certificate; Paying to register for a Board of Inland Revenue of the Ministry of Finance is responsible for approving all

Bulk Sales Tax Form Department of Taxation and Finance

The time it takes to Dissolve a Pennsylvania LLC varies a Tax Clearance Certificate from the of Revenue to process a request for a Tax

Application for a Tax Clearance Certificate TC1 This application form is only to be used by the following Application for Tax Clearance Certificate (REV-181)

Help with forms and publications Canada.ca

Notices gra.gov.gy

1.3 Myanmar Customs Information Logistics Capacity

2013-2018 Form PA DoR REV-181 Fill Online Printable

Sales & Use Tax Department of Revenue

How to Dissolve an LLC in Pennsylvania Nolo.com

https://en.wikipedia.org/wiki/Community_tax_certificate_(Philippines)

Free guide to dissolve a Pennsylvania Corporation

– TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

Form 712 Instructions WordPress.com

Selling Canadian Assets When are s. 116 certificates

YouTube Embed: No video/playlist ID has been supplied

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

2013-2018 Form PA DoR REV-181 Fill Online Printable

Get the Application for Tax Clearance Certificate (REV-181

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

Pennsylvania Tax Information & Forms . Form 100 – Department of Revenue Enterprise Registration Form. Form 181 – Application for Tax Clearance Certificate.

Applying for Tax Clearance Certificate; Paying to register for a Board of Inland Revenue of the Ministry of Finance is responsible for approving all

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

Customs – Tanzania Presentation by the apply for the SBE and must submit the following documents with the Certificate of Origin; and other certificates if any.

Exemption Certificate Application Certificate is required for tax exemptions. Certificate is the Ministry of Shipping.Out of 181 border check-posts 13 Land

The time it takes to Dissolve a Pennsylvania LLC varies a Tax Clearance Certificate from the of Revenue to process a request for a Tax

Dale & Lessmann LLP bietet How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

Notices gra.gov.gy

Free guide to withdraw or cancel a foreign Pennsylvania

The application for Tax Exemption Certificate by department or state enterprise due to lack of set revenue. as fine for duty bond clearance in (181-360)

August 30, 2016 CRA Says It Will Issue Clearance Certificates for Partial Estate Distributions. The CRA said that legal representatives of a graduated rate estate may

How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax Dale & Lessmann LLP Office

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

Land tax clearance certificate changes; Application of Aggregation Provisions (This ruling should be read in conjunction with Revenue Ruling SD 078)

2011-07-15 · How do I dissolve the llc in PA? In order to obtain the tax clearance certificate, an Application for Tax Clearance Certificate, Form REV-181 must be

Tax Exemption, Processing & Verification; Notice of Cut-Off Date for Application of Tobacco Excise Stamps: 181: Invitation For Bid

To obtain this certificate one should fill out and file the form REV-181. What is a REV-181 form for? This form is a PA application for a Tax Clearance Certificate. The business owner should file this certificate with the court for the dissolution of the business entity. Is an REV-181 form accompanied by other forms?

Certificate Of Termination Domestic General Partnership a Form REV-181 (Application for Tax Clearance Certificate) Certificate Of Termination Domestic General

How to withdraw a foreign Pennsylvania LLC or corporation Submit an Application for Tax Clearance Certificate (REV-181) Send your Tax Clearance Application to:

When is an Estate Trustee Obligated to Make an to file tax returns for the obtain a clearance certificate from the Canada Revenue Agency before

Land tax clearance certificate v Chief Commissioner of State Revenue [2011 to make a profit in the particular tax year for the exemption to apply.

Indian regulations for expatriates working in India

Clearance Information uc.pa.gov

Form 801—General Information (Application for Reinstatement and Request to Set Aside Tax Clearance: A certificate of reinstatement must be accompanied by a tax

When is an Estate Trustee Obligated to Make an to file tax returns for the obtain a clearance certificate from the Canada Revenue Agency before

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

Tanzania Revenue Authority Tax Identification Number (TIN) Certificate of a Company 12. Filling fee for the application,

August 30, 2016 CRA Says It Will Issue Clearance Certificates for Partial Estate Distributions. The CRA said that legal representatives of a graduated rate estate may

2015 Pennsylvania Capital Stock/Foreign Franchise Tax Filing by the Pennsylvania Department of Revenue for (Application for Tax Clearance Certificate).

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

2011-07-15 · How do I dissolve the llc in PA? In order to obtain the tax clearance certificate, an Application for Tax Clearance Certificate, Form REV-181 must be

How long from the date I apply for a Corporate Clearance Certificate (REV-181) will it take to receive the certificate?

Pennsylvania Tax Information & Forms . Form 100 – Department of Revenue Enterprise Registration Form. Form 181 – Application for Tax Clearance Certificate.

Dale & Lessmann LLP bietet How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax

A tax clearance letter (known in Pennsylvania as a Application for Tax Clearance Certificate, to request a bulk sale clearance certificate. (Form REV-181 can be

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO: ELS19/2018 C4 Site Information 178- 181 – 4 – A copy of a valid Tax Clearance Certificate issued …

Business Tax Clearance Certification Required for Receiving State A Tax Clearance Certificate will only be issued to businesses or individuals who are

Form 712 Instructions Application for Special Motorcycle Washroom Equipment, Inc. REV-181-I — Instructions For Securing a Tax Clearance Certificate To File

CRA Says It Will Issue Clearance Certificates for Partial

Selling Canadian Assets When are s. 116 certificates

assessment and wishes to register for turnover tax, the application must be SARS Revenue Branch Total annual turnover Total annual tax payable 0 – 181

… phase out the capital stock and foreign franchise tax, and Foreign Franchise Tax, they should file a Form REV-181, Application for Tax Clearance Certificate.

Ontario lawyers provide answers to questions about wills and an estate certificate for which application is applies for a tax clearance certificate.

Land tax clearance certificate v Chief Commissioner of State Revenue [2011 to make a profit in the particular tax year for the exemption to apply.

Department of Taxation and Finance. sales must register with the Tax Department and obtain a Certificate of Apply for a Certificate of Authority

Pennsylvania Tax Information & Forms . Form 100 – Department of Revenue Enterprise Registration Form. Form 181 – Application for Tax Clearance Certificate.

Online Printing Now Available for NJ Tax Clearance certificate eliminates the paper application be imposed under the Internal Revenue

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

Form 801—General Information (Application for Reinstatement and Request to Set Aside Tax Clearance: A certificate of reinstatement must be accompanied by a tax

To obtain this certificate one should fill out and file the form REV-181. What is a REV-181 form for? This form is a PA application for a Tax Clearance Certificate. The business owner should file this certificate with the court for the dissolution of the business entity. Is an REV-181 form accompanied by other forms?

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

69 The application for the Tax Clearance Certificate is the 70 responsibility of the bidder and must be submitted directly to the DOTAX 71 or IRS. The approved certificate …

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

Get the Application for Tax Clearance Certificate (REV-181

Florida Department of Revenue. Home; Taxes; Request for Tax Clearance Letter or Certificate of To receive Certificate of Compliance or a Clearance Letter you

Successor Liability for State Income and Franchise Taxes Pennsylvania Form REV-181, Application for Tax Clearance Certificate, is used for this

plete the Application for T ax Clearance Certificate, REV-181. with processing paper tax. PA Enterprise Registration Form and Instructions PDF. Favor this

The time it takes to Dissolve a Pennsylvania LLC varies a Tax Clearance Certificate from the of Revenue to process a request for a Tax

Property taxes are the City of Pickering’s main source of revenue in 181/03 (Municipal Tax Certificate if any portion of property taxes remains

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

(1) Submitting an Application for Tax Clearance Certificate (REV 181) (2) Filing the appropriate tax reports/returns and paying all taxes interest and penalties

69 The application for the Tax Clearance Certificate is the 70 responsibility of the bidder and must be submitted directly to the DOTAX 71 or IRS. The approved certificate …

Exemption Certificate Application Certificate is required for tax exemptions. Certificate is the Ministry of Shipping.Out of 181 border check-posts 13 Land

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

* REV-181 Application for Tax Clearance * REV-183 Affidavit of Value Realty Transfer Tax * REV-221 Sales & Use Tax Rate Chart * REV-227 Sales & Use Tax Credit Chart * REV-229 Estate Tax General Information * REV-238 Out of Existence/Withdrawal Affidavit/Corp Tax

Applying for Tax Clearance Certificate; Paying to register for a Board of Inland Revenue of the Ministry of Finance is responsible for approving all

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

Businesses in Tanzania will now need a tax clearance certificate from Dar traders will need tax certificates to renew certificate from the Tanzania Revenue

obtain these clearance certificates, Form REV-181 (Application for Tax Clearance Certificate) 15-415_417 Withdrawal Foreign Registration

Form 712 Instructions WordPress.com

1.3 Myanmar Customs Information Logistics Capacity

Certificate of Origin (Form 434) Preparation Guide “For Customs Clearance by FedEx Trade Networks Time limits apply;

* REV-181 Application for Tax Clearance * REV-183 Affidavit of Value Realty Transfer Tax * REV-221 Sales & Use Tax Rate Chart * REV-227 Sales & Use Tax Credit Chart * REV-229 Estate Tax General Information * REV-238 Out of Existence/Withdrawal Affidavit/Corp Tax

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

obtain these clearance certificates, Form REV-181 (Application for Tax Clearance Certificate) 15-415_417 Withdrawal Foreign Registration

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

Dar traders will need tax certificates to renew licences

When is an Estate Trustee Obligated to Make an to file tax returns for the obtain a clearance certificate from the Canada Revenue Agency before

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

(1) Submitting an Application for Tax Clearance Certificate (REV 181) (2) Filing the appropriate tax reports/returns and paying all taxes interest and penalties

Certificate of Origin (Form 434) Preparation Guide “For Customs Clearance by FedEx Trade Networks Time limits apply;

* REV-181 Application for Tax Clearance * REV-183 Affidavit of Value Realty Transfer Tax * REV-221 Sales & Use Tax Rate Chart * REV-227 Sales & Use Tax Credit Chart * REV-229 Estate Tax General Information * REV-238 Out of Existence/Withdrawal Affidavit/Corp Tax

… phase out the capital stock and foreign franchise tax, and Foreign Franchise Tax, they should file a Form REV-181, Application for Tax Clearance Certificate.

The application for Tax Exemption Certificate by department or state enterprise due to lack of set revenue. as fine for duty bond clearance in (181-360)

Ontario lawyers provide answers to questions about wills and an estate certificate for which application is applies for a tax clearance certificate.

A written clearance must be obtained from the Department of Labor & Industry (L&I) and the Department of Revenue (DOR) before the transaction with DOS will be approved. To obtain this clearance certificate, Form REV-181, Application for Tax Clearance Certificate, must be completed.

2011-07-15 · How do I dissolve the llc in PA? In order to obtain the tax clearance certificate, an Application for Tax Clearance Certificate, Form REV-181 must be

Tanzania Revenue Authority Tax Identification Number (TIN) Certificate of a Company 12. Filling fee for the application,

Property Taxes City of Pickering

PA Bulletin Doc. No. 01-1430j

COMPLIANCE ISSUES IN CURRENT ENVIRONMENT • Corporate Tax TAX COMPLIANCE ISSUES IN CURRENT Failure to deduct 10% tax where tax clearance

The time it takes to Dissolve a Pennsylvania LLC varies a Tax Clearance Certificate from the of Revenue to process a request for a Tax

A written clearance must be obtained from the Department of Labor & Industry (L&I) and the Department of Revenue (DOR) before the transaction with DOS will be approved. To obtain this clearance certificate, Form REV-181, Application for Tax Clearance Certificate, must be completed.

… phase out the capital stock and foreign franchise tax, and Foreign Franchise Tax, they should file a Form REV-181, Application for Tax Clearance Certificate.

Property taxes are the City of Pickering’s main source of revenue in 181/03 (Municipal Tax Certificate if any portion of property taxes remains

assessment and wishes to register for turnover tax, the application must be SARS Revenue Branch Total annual turnover Total annual tax payable 0 – 181

(1) Submitting an Application for Tax Clearance Certificate (REV 181) (2) Filing the appropriate tax reports/returns and paying all taxes interest and penalties

Land tax clearance certificate v Chief Commissioner of State Revenue [2011 to make a profit in the particular tax year for the exemption to apply.

Online Printing Now Available for NJ Tax Clearance certificate eliminates the paper application be imposed under the Internal Revenue

Wills Information from Toronto lawyers Wagner

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

2015 Pennsylvania Capital Stock/Foreign Franchise Tax Filing by the Pennsylvania Department of Revenue for (Application for Tax Clearance Certificate).

Category: Circulars. 2017- DRAFT ESTIMATES OF REVENUE AND EXPENDITURE OF MINISTRIES AND DEPARTMENTS Applying for Tax Clearance Certificate…

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

assessment and wishes to register for turnover tax, the application must be SARS Revenue Branch Total annual turnover Total annual tax payable 0 – 181

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

DISSOLVE, CANCEL, OR WITHDRAW A BUSINESS. a Tax Clearance Certificate must be issued for both domestic and Access online Dissolution/Cancellation Application;

View, download and print Ftb 3571 C2 – Request For Estate Income Tax Clearance Certificate – 2007 pdf template or form online. 2253 California Tax …

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

Florida Department of Revenue. Home; Taxes; Request for Tax Clearance Letter or Certificate of To receive Certificate of Compliance or a Clearance Letter you

Find out how to go about dissolving an LLC in Pennsylvania. REV-181 (Application for Tax Clearance application for a tax clearance certificate and a

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

Tanzania Revenue Authority Tax Identification Number (TIN) Certificate of a Company 12. Filling fee for the application,

… phase out the capital stock and foreign franchise tax, and Foreign Franchise Tax, they should file a Form REV-181, Application for Tax Clearance Certificate.

To apply for a refund of Retail Sales Tax paid on insurance or benefit plan premiums. Application for Vendor Permit RST Clearance Certificate Checklist

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

Form 712 Instructions WordPress.com

The Kentucky Sales & Use Tax returns (forms 51A102, Service provider fees may apply. Tax Payment Solution Division of Sales and Use Tax Station 67 PO Box 181

16 A tax clearance certificate may be obtained by filing an Application for Tax Clearance Certificate Form REV-181. The application may be obtained on Commonwealth of Pennsylvania Department of Revenue website, www.revenue.state.pa.us or by calling (717) 783-6055. The fiscal code governing tax clearance certificates may be found at …

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

COMPLIANCE ISSUES IN CURRENT ENVIRONMENT • Corporate Tax TAX COMPLIANCE ISSUES IN CURRENT Failure to deduct 10% tax where tax clearance

Form 801—General Information (Application for Reinstatement and Request to Set Aside Tax Clearance: A certificate of reinstatement must be accompanied by a tax

plete the Application for T ax Clearance Certificate, REV-181. with processing paper tax. PA Enterprise Registration Form and Instructions PDF. Favor this

Business Tax Clearance Certification Required for Receiving State A Tax Clearance Certificate will only be issued to businesses or individuals who are

A written clearance must be obtained from the Department of Labor & Industry (L&I) and the Department of Revenue (DOR) before the transaction with DOS will be approved. To obtain this clearance certificate, Form REV-181, Application for Tax Clearance Certificate, must be completed.

Ontario lawyers provide answers to questions about wills and an estate certificate for which application is applies for a tax clearance certificate.

Form REV-181 Fillable Application for Tax Clearance Certificate (REV-181 181 Fillable Application for Tax Clearance Certificate (REV-181) (all forms

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

How long from the date I apply for a Corporate Clearance Certificate (REV-181) will it take to receive the certificate?

How long from the date I apply for a Corporate Clearance

How to Obtain Tax Clearance in Pennsylvania Nolo.com

Department of Taxation and Finance. sales must register with the Tax Department and obtain a Certificate of Apply for a Certificate of Authority

49 The application for the Tax Clearance Certificate is the 50 APPLICATION FOR CERTIFICATE OF 181 accordance with Subsection 103.06

… for license application or renewal until the tax Revenue must issue a tax clearance must be 181, the Department of Revenue has the

To obtain this certificate one should fill out and file the form REV-181. What is a REV-181 form for? This form is a PA application for a Tax Clearance Certificate. The business owner should file this certificate with the court for the dissolution of the business entity. Is an REV-181 form accompanied by other forms?

Florida Department of Revenue. Home; Taxes; Request for Tax Clearance Letter or Certificate of To receive Certificate of Compliance or a Clearance Letter you

… Successor liability for state income and franchise taxes. by “The Tax Pennsylvania Form REV-181, Application for Tax Clearance Clearance Certificate …

View, download and print Ftb 3571 C2 – Request For Estate Income Tax Clearance Certificate – 2007 pdf template or form online. 2253 California Tax …

Category: Circulars. 2017- DRAFT ESTIMATES OF REVENUE AND EXPENDITURE OF MINISTRIES AND DEPARTMENTS Applying for Tax Clearance Certificate…

Successor Liability for State Income and Franchise Taxes Pennsylvania Form REV-181, Application for Tax Clearance Certificate, is used for this

(1) Submitting an Application for Tax Clearance Certificate (REV 181) (2) Filing the appropriate tax reports/returns and paying all taxes interest and penalties

Land tax clearance certificate changes; Application of Aggregation Provisions (This ruling should be read in conjunction with Revenue Ruling SD 078)

2015 Pennsylvania Capital Stock/Foreign Franchise Tax Filing by the Pennsylvania Department of Revenue for (Application for Tax Clearance Certificate).

COMPLIANCE ISSUES IN CURRENT ENVIRONMENT • Corporate Tax TAX COMPLIANCE ISSUES IN CURRENT Failure to deduct 10% tax where tax clearance

Successor Liability for State Income and Franchise Taxes

Clearance Information uc.pa.gov

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

DISSOLVE, CANCEL, OR WITHDRAW A BUSINESS. a Tax Clearance Certificate must be issued for both domestic and Access online Dissolution/Cancellation Application;

… Successor liability for state income and franchise taxes. by “The Tax Pennsylvania Form REV-181, Application for Tax Clearance Clearance Certificate …

49 The application for the Tax Clearance Certificate is the 50 APPLICATION FOR CERTIFICATE OF 181 accordance with Subsection 103.06

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

The time it takes to Dissolve a Pennsylvania LLC varies a Tax Clearance Certificate from the of Revenue to process a request for a Tax

… for license application or renewal until the tax Revenue must issue a tax clearance must be 181, the Department of Revenue has the

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

Certificate of Origin (Form 434) Preparation Guide

Sales & Use Tax Department of Revenue

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO: ELS19/2018 C4 Site Information 178- 181 – 4 – A copy of a valid Tax Clearance Certificate issued …

… for license application or renewal until the tax Revenue must issue a tax clearance must be 181, the Department of Revenue has the

Exemption Certificate Application Certificate is required for tax exemptions. Certificate is the Ministry of Shipping.Out of 181 border check-posts 13 Land

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

2015 Pennsylvania Capital Stock/Foreign Franchise Tax Filing by the Pennsylvania Department of Revenue for (Application for Tax Clearance Certificate).

… Successor liability for state income and franchise taxes. by “The Tax Pennsylvania Form REV-181, Application for Tax Clearance Clearance Certificate …

COMPLIANCE ISSUES IN CURRENT ENVIRONMENT • Corporate Tax TAX COMPLIANCE ISSUES IN CURRENT Failure to deduct 10% tax where tax clearance

plete the Application for T ax Clearance Certificate, REV-181. with processing paper tax. PA Enterprise Registration Form and Instructions PDF. Favor this

assessment and wishes to register for turnover tax, the application must be SARS Revenue Branch Total annual turnover Total annual tax payable 0 – 181

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

PA Department of State must file REV-181, Application for Tax Clearance Certificate. a certificate of organization must be filed with the PA Department of State.

The time it takes to Dissolve a Pennsylvania LLC varies a Tax Clearance Certificate from the of Revenue to process a request for a Tax

Customs – Tanzania Presentation by the apply for the SBE and must submit the following documents with the Certificate of Origin; and other certificates if any.

Tanzania Revenue Authority Tax Identification Number (TIN) Certificate of a Company 12. Filling fee for the application,

Probate Court Forms

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

The application for Tax Exemption Certificate by department or state enterprise due to lack of set revenue. as fine for duty bond clearance in (181-360)

How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax Dale & Lessmann LLP Office

Businesses in Tanzania will now need a tax clearance certificate from Dar traders will need tax certificates to renew certificate from the Tanzania Revenue

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

Form REV-181-I Fillable Instructions For Securing a Tax

Wills Information from Toronto lawyers Wagner

COMPLIANCE ISSUES IN CURRENT ENVIRONMENT • Corporate Tax TAX COMPLIANCE ISSUES IN CURRENT Failure to deduct 10% tax where tax clearance

Online Printing Now Available for NJ Tax Clearance certificate eliminates the paper application be imposed under the Internal Revenue

(1) Submitting an Application for Tax Clearance Certificate (REV 181) (2) Filing the appropriate tax reports/returns and paying all taxes interest and penalties

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

2011-07-15 · How do I dissolve the llc in PA? In order to obtain the tax clearance certificate, an Application for Tax Clearance Certificate, Form REV-181 must be

How to withdraw a foreign Pennsylvania LLC or corporation Submit an Application for Tax Clearance Certificate (REV-181) Send your Tax Clearance Application to:

Business Tax Clearance Certification Required for Receiving State A Tax Clearance Certificate will only be issued to businesses or individuals who are

Sales & Use Tax Department of Revenue

ACCOUNTING TECHNICIANS SCHEME OF WEST AFRICA

Probate Court Forms can be found at the Department of Revenue Service’s website. Estate Tax Forms of Public Health to Issue Original Birth Certificate (Rev. 7

application for tax clearance certificate-Oyxter Znaleziska

Wills Information from Toronto lawyers Wagner

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

How long from the date I apply for a Corporate Clearance Certificate (REV-181) will it take to receive the certificate?

How to Dissolve an LLC in Pennsylvania Nolo.com

Certificate of Origin (Form 434) Preparation Guide “For Customs Clearance by FedEx Trade Networks Time limits apply;

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

The application for Tax Exemption Certificate by department or state enterprise due to lack of set revenue. as fine for duty bond clearance in (181-360)

Category Circulars Ministry of Finance

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

Clearance Information uc.pa.gov

Notices gra.gov.gy

DISSOLVE, CANCEL, OR WITHDRAW A BUSINESS. a Tax Clearance Certificate must be issued for both domestic and Access online Dissolution/Cancellation Application;

Licenses Department of Revenue

How do I dissolve the llc in PA? Yahoo Answers

How to Obtain Tax Clearance in Pennsylvania Nolo.com

To apply for a refund of Retail Sales Tax paid on insurance or benefit plan premiums. Application for Vendor Permit RST Clearance Certificate Checklist

Wills Information from Toronto lawyers Wagner

Dar traders will need tax certificates to renew licences

plete the Application for T ax Clearance Certificate, REV-181. with processing paper tax. PA Enterprise Registration Form and Instructions PDF. Favor this

Certificate Of Termination Domestic General Partnership

49 The application for the Tax Clearance Certificate is the 50 APPLICATION FOR CERTIFICATE OF 181 accordance with Subsection 103.06

Bulk Sales Tax Form Department of Taxation and Finance

Sales & Use Tax Department of Revenue

Selling Canadian Assets When are s. 116 certificates

A tax clearance letter (known in Pennsylvania as a Application for Tax Clearance Certificate, to request a bulk sale clearance certificate. (Form REV-181 can be

Ministry of Finance

How long from the date I apply for a Corporate Clearance Certificate (REV-181) will it take to receive the certificate?

Successor Liability for State Income and Franchise Taxes

Dar traders will need tax certificates to renew licences

15-415 417 Withdrawal Foreign Registration

How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax Dale & Lessmann LLP Office

1.3 Myanmar Customs Information Logistics Capacity

M. Burr Keim Company Pennsylvania Tax Forms

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

This page explains how to access and use forms and publications available on the Canada Revenue Agency Web site. It includes information about ordering, paper format

Probate Court Forms

Successor Liability for State Income and Franchise Taxes

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

Land tax clearance certificate v Chief Commissioner of State Revenue [2011 to make a profit in the particular tax year for the exemption to apply.

Pa Exemption Certificate Rev 1220 9 08i Fill Online

Licenses Department of Revenue

August 30, 2016 CRA Says It Will Issue Clearance Certificates for Partial Estate Distributions. The CRA said that legal representatives of a graduated rate estate may

Bulk Sales Tax Form Department of Taxation and Finance

PA Bulletin Doc. No. 01-1430j

How do I dissolve the llc in PA? Yahoo Answers

View, download and print Ftb 3571 C2 – Request For Estate Income Tax Clearance Certificate – 2007 pdf template or form online. 2253 California Tax …

PA Capital Stock and Foreign Franchise Tax Expires in

Successor Liability for State Income and Franchise Taxes Pennsylvania Form REV-181, Application for Tax Clearance Certificate, is used for this

Successor Liability for State Income and Franchise Taxes

Business Tax Clearance Certification Required for Receiving State A Tax Clearance Certificate will only be issued to businesses or individuals who are

PA-100 PA Enterprise Registration Form and Instructions

Sales & Use Tax Department of Revenue

The application for Tax Exemption Certificate by department or state enterprise due to lack of set revenue. as fine for duty bond clearance in (181-360)

Form 712 Instructions WordPress.com

Form REV-181 Fillable Application for Tax Clearance

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

Land tax clearance certificate changes; Application of Aggregation Provisions (This ruling should be read in conjunction with Revenue Ruling SD 078)

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

Businesses in Tanzania will now need a tax clearance certificate from Dar traders will need tax certificates to renew certificate from the Tanzania Revenue

Pa Exemption Certificate Rev 1220 9 08i Fill Online

ACCOUNTING TECHNICIANS SCHEME OF WEST AFRICA

Category: Circulars. 2017- DRAFT ESTIMATES OF REVENUE AND EXPENDITURE OF MINISTRIES AND DEPARTMENTS Applying for Tax Clearance Certificate…

PA Bulletin Doc. No. 01-1430j

How to Dissolve an LLC in Pennsylvania Nolo.com

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

… for license application or renewal until the tax Revenue must issue a tax clearance must be 181, the Department of Revenue has the

Stamp duty Revenue NSW

Clearance Information uc.pa.gov

2015 Pennsylvania Capital Stock/Foreign Franchise Tax

PA Department of State must file REV-181, Application for Tax Clearance Certificate. a certificate of organization must be filed with the PA Department of State.

How to Dissolve an LLC in Pennsylvania Nolo.com

a project of Philadelphia VIP NONPROFIT

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

Turnover Tax SARS

a project of Philadelphia VIP NONPROFIT

Dar traders will need tax certificates to renew licences

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

Department of Taxation Hawaii Tax Forms

Department of Taxation and Finance. sales must register with the Tax Department and obtain a Certificate of Apply for a Certificate of Authority

Why do I need to Dissolve a Pennsylvania LLC?

Indian regulations for expatriates working in India

Form REV-181-I Fillable Instructions For Securing a Tax

Exemption Certificate Application Certificate is required for tax exemptions. Certificate is the Ministry of Shipping.Out of 181 border check-posts 13 Land

Sales & Use Tax Department of Revenue

Probate Court Forms

Business Tax Clearance Certification Required for Receiving State A Tax Clearance Certificate will only be issued to businesses or individuals who are

revenue 651 Medicare codes PDF

2.10 Tax Clearance Certificate .. 181 9.2 Withholding Tax Rates 11.1 Meaning and Application of Value Added Tax

PA Bulletin Doc. No. 01-1430j

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

Bulk Sales Tax Form Department of Taxation and Finance

Certificate of Origin (Form 434) Preparation Guide

Tax Exemption, Processing & Verification; Notice of Cut-Off Date for Application of Tobacco Excise Stamps: 181: Invitation For Bid

2015 Pennsylvania Capital Stock/Foreign Franchise Tax

Dissolve Cancel or Withdraw a Business New Jersey

A tax clearance letter (known in Pennsylvania as a Application for Tax Clearance Certificate, to request a bulk sale clearance certificate. (Form REV-181 can be

2015 Pennsylvania Capital Stock/Foreign Franchise Tax

CONTACT INFORMATION SUBCHAPTER S

PA Bulletin Doc. No. 01-1430j

The type of tax return in which you report the LLC’s income and expenses depends on the tax structure you choose to apply. Revenue Service imposes separate tax

Help with forms and publications Canada.ca

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

Dar traders will need tax certificates to renew licences

… for license application or renewal until the tax Revenue must issue a tax clearance must be 181, the Department of Revenue has the

application for tax clearance certificate-Oyxter Znaleziska

Form 712 Instructions WordPress.com

49 The application for the Tax Clearance Certificate is the 50 APPLICATION FOR CERTIFICATE OF 181 accordance with Subsection 103.06

CONTACT INFORMATION SUBCHAPTER S

CRA Says It Will Issue Clearance Certificates for Partial

Get the Application for Tax Clearance Certificate (REV-181

Real Estate Buyer Beware the seller must file form REV-181, the Application for Tax Clearance Seller shall apply for a Bulk Sales Clearance certificate to

15-415 417 Withdrawal Foreign Registration

Turnover Tax SARS

Category: Circulars. 2017- DRAFT ESTIMATES OF REVENUE AND EXPENDITURE OF MINISTRIES AND DEPARTMENTS Applying for Tax Clearance Certificate…

PA Capital Stock and Foreign Franchise Tax Expires in

Stamp duty Revenue NSW

DISSOLVE, CANCEL, OR WITHDRAW A BUSINESS. a Tax Clearance Certificate must be issued for both domestic and Access online Dissolution/Cancellation Application;

Notices gra.gov.gy

Please attach the following information with your application: Certificate to the Minnesota Commissioner of Revenue the Minnesota business tax 176.181 , Subd

application for tax clearance certificate-Oyxter Znaleziska

When is an Estate Trustee Obligated to Make an to file tax returns for the obtain a clearance certificate from the Canada Revenue Agency before

Why do I need to Dissolve a Pennsylvania LLC?

a project of Philadelphia VIP NONPROFIT

Ontario lawyers provide answers to questions about wills and an estate certificate for which application is applies for a tax clearance certificate.

103A96E. AWARD AND EXECUTION OF CONTRACT

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO

Clearance Information uc.pa.gov

Property taxes are the City of Pickering’s main source of revenue in 181/03 (Municipal Tax Certificate if any portion of property taxes remains

PA Bulletin Doc. No. 01-1430j

person who spends more than 181 Income Tax Clearance Certificate Indian regulations for expatriates working in India Ready for all your queries 5.

CONTACT INFORMATION SUBCHAPTER S

Clearance Information uc.pa.gov

August 30, 2016 CRA Says It Will Issue Clearance Certificates for Partial Estate Distributions. The CRA said that legal representatives of a graduated rate estate may

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF

Sales & Use Tax Department of Revenue

The type of tax return in which you report the LLC’s income and expenses depends on the tax structure you choose to apply. Revenue Service imposes separate tax

Notices gra.gov.gy

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

Dissolve Cancel or Withdraw a Business New Jersey

Successor liability for state income and franchise taxes

Tax Exemption, Processing & Verification; Notice of Cut-Off Date for Application of Tobacco Excise Stamps: 181: Invitation For Bid

M. Burr Keim Company Pennsylvania Tax Forms

Property Taxes City of Pickering

Form REV-181-I Fillable Instructions For Securing a Tax

Land tax clearance certificate v Chief Commissioner of State Revenue [2011 to make a profit in the particular tax year for the exemption to apply.

Online Printing Now Available for NJ Tax Clearance

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

Category Circulars Ministry of Finance

1.3 Bangladesh Customs Information Logistics Capacity

When is Estate Trustee Obligated to Make Interim

Information about the income tax rules that apply to non-residents of Canada. see the Canada Revenue Agency’s Non-resident tax calculator or contact the Canada

Wills Information from Toronto lawyers Wagner

Successor Liability for State Income and Franchise Taxes Pennsylvania Form REV-181, Application for Tax Clearance Certificate, is used for this

Successor liability for state income and franchise taxes

To obtain this certificate one should fill out and file the form REV-181. What is a REV-181 form for? This form is a PA application for a Tax Clearance Certificate. The business owner should file this certificate with the court for the dissolution of the business entity. Is an REV-181 form accompanied by other forms?

Form 712 Instructions WordPress.com

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

Form REV-181 Fillable Application for Tax Clearance

… Successor liability for state income and franchise taxes. by “The Tax Pennsylvania Form REV-181, Application for Tax Clearance Clearance Certificate …

Selling Canadian Assets When are s. 116 certificates

Category Circulars Ministry of Finance

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

Probate Court Forms

2015 Pennsylvania Capital Stock/Foreign Franchise Tax

Real Estate Buyer Beware the seller must file form REV-181, the Application for Tax Clearance Seller shall apply for a Bulk Sales Clearance certificate to

revenue 651 Medicare codes PDF

How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax Dale & Lessmann LLP Office

Ministry of Finance

Dale & Lessmann LLP bietet How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax

Free guide to dissolve a Pennsylvania Corporation

plete the Application for T ax Clearance Certificate, REV-181. with processing paper tax. PA Enterprise Registration Form and Instructions PDF. Favor this

application for tax clearance certificate-Oyxter Znaleziska

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

Property Taxes City of Pickering

Pa Exemption Certificate Rev 1220 9 08i Fill Online

Customs – Tanzania Presentation by the apply for the SBE and must submit the following documents with the Certificate of Origin; and other certificates if any.

Indian regulations for expatriates working in India

plete the Application for T ax Clearance Certificate, REV-181. with processing paper tax. PA Enterprise Registration Form and Instructions PDF. Favor this

1.3 Myanmar Customs Information Logistics Capacity

Successor Liability for State Income and Franchise Taxes

Clearance Information uc.pa.gov

49 The application for the Tax Clearance Certificate is the 50 APPLICATION FOR CERTIFICATE OF 181 accordance with Subsection 103.06

How do I dissolve the llc in PA? Yahoo Answers

Pennsylvania Tax Information & Forms . Form 100 – Department of Revenue Enterprise Registration Form. Form 181 – Application for Tax Clearance Certificate.

103A96E. AWARD AND EXECUTION OF CONTRACT

Help with forms and publications Canada.ca

ACCOUNTING TECHNICIANS SCHEME OF WEST AFRICA

Application for a Tax Clearance Certificate TC1 This application form is only to be used by the following Application for Tax Clearance Certificate (REV-181)

103A96E. AWARD AND EXECUTION OF CONTRACT

Successor Liability for State Income and Franchise Taxes

Online Printing Now Available for NJ Tax Clearance

Information about the income tax rules that apply to non-residents of Canada. see the Canada Revenue Agency’s Non-resident tax calculator or contact the Canada

Property Taxes City of Pickering

… Successor liability for state income and franchise taxes. by “The Tax Pennsylvania Form REV-181, Application for Tax Clearance Clearance Certificate …

Why do I need to Dissolve a Pennsylvania LLC?

Form REV-181 Fillable Application for Tax Clearance

Certificate of Origin (Form 434) Preparation Guide

To obtain this certificate one should fill out and file the form REV-181. What is a REV-181 form for? This form is a PA application for a Tax Clearance Certificate. The business owner should file this certificate with the court for the dissolution of the business entity. Is an REV-181 form accompanied by other forms?

application for tax clearance certificate-Oyxter Znaleziska

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF

PA Department of State must file REV-181, Application for Tax Clearance Certificate. a certificate of organization must be filed with the PA Department of State.

Bulk Sales Tax Form Department of Taxation and Finance

How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax Dale & Lessmann LLP Office

Get the Application for Tax Clearance Certificate (REV-181

Indian regulations for expatriates working in India

ACCOUNTING TECHNICIANS SCHEME OF WEST AFRICA

Tanzania Revenue Authority Tax Identification Number (TIN) Certificate of a Company 12. Filling fee for the application,

Stamp duty Revenue NSW

Ministry of Finance

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

Sales & Use Tax Department of Revenue

Certificate of Origin (Form 434) Preparation Guide

PA Department of State must file REV-181, Application for Tax Clearance Certificate. a certificate of organization must be filed with the PA Department of State.

ACCOUNTING TECHNICIANS SCHEME OF WEST AFRICA

Certificate of Origin (Form 434) Preparation Guide “For Customs Clearance by FedEx Trade Networks Time limits apply;

Bulk Sales Tax Form Department of Taxation and Finance

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

Probate Court Forms can be found at the Department of Revenue Service’s website. Estate Tax Forms of Public Health to Issue Original Birth Certificate (Rev. 7

Help with forms and publications Canada.ca

The type of tax return in which you report the LLC’s income and expenses depends on the tax structure you choose to apply. Revenue Service imposes separate tax

When is Estate Trustee Obligated to Make Interim

PA-100 PA Enterprise Registration Form and Instructions

Department of Taxation and Finance. sales must register with the Tax Department and obtain a Certificate of Apply for a Certificate of Authority

Clearance Information uc.pa.gov

Form 712 Instructions WordPress.com

Tax Exemption, Processing & Verification; Notice of Cut-Off Date for Application of Tobacco Excise Stamps: 181: Invitation For Bid

Free guide to dissolve a Pennsylvania Corporation

Form 712 Instructions WordPress.com

Online Printing Now Available for NJ Tax Clearance certificate eliminates the paper application be imposed under the Internal Revenue

application for tax clearance certificate-Oyxter Znaleziska

Form REV-181 Fillable Application for Tax Clearance

15-415 417 Withdrawal Foreign Registration

August 30, 2016 CRA Says It Will Issue Clearance Certificates for Partial Estate Distributions. The CRA said that legal representatives of a graduated rate estate may

How to Dissolve an LLC in Pennsylvania Nolo.com

Revenue Ruling No. LT 097 Revenue NSW

Successor liability for state income and franchise taxes

Application for a Tax Clearance Certificate TC1 This application form is only to be used by the following Application for Tax Clearance Certificate (REV-181)

How to Dissolve an LLC in Pennsylvania Nolo.com

M. Burr Keim Company Pennsylvania Tax Forms

Successor Liability for State Income and Franchise Taxes Pennsylvania Form REV-181, Application for Tax Clearance Certificate, is used for this

Certificate of Origin (Form 434) Preparation Guide

Turnover Tax SARS

16 A tax clearance certificate may be obtained by filing an Application for Tax Clearance Certificate Form REV-181. The application may be obtained on Commonwealth of Pennsylvania Department of Revenue website, http://www.revenue.state.pa.us or by calling (717) 783-6055. The fiscal code governing tax clearance certificates may be found at …

Customs Tanzania – United Nations

application for tax clearance certificate-Oyxter Znaleziska

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

1.3 Myanmar Customs Information Logistics Capacity

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF

Probate Court Forms

Certificate Of Termination Domestic General Partnership a Form REV-181 (Application for Tax Clearance Certificate) Certificate Of Termination Domestic General

Turnover Tax SARS

Why do I need to Dissolve a Pennsylvania LLC?

Dar traders will need tax certificates to renew licences

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

Customs Tanzania – United Nations

When is Estate Trustee Obligated to Make Interim

This page explains how to access and use forms and publications available on the Canada Revenue Agency Web site. It includes information about ordering, paper format

PA Capital Stock and Foreign Franchise Tax Expires in

A tax clearance letter (known in Pennsylvania as a Application for Tax Clearance Certificate, to request a bulk sale clearance certificate. (Form REV-181 can be

Help with forms and publications Canada.ca

PA Bulletin Doc. No. 01-1430j

Please attach the following information with your application: Certificate to the Minnesota Commissioner of Revenue the Minnesota business tax 176.181 , Subd

Get the Application for Tax Clearance Certificate (REV-181

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

Successor liability for state income and franchise taxes

Form 712 Instructions Application for Special Motorcycle Washroom Equipment, Inc. REV-181-I — Instructions For Securing a Tax Clearance Certificate To File

Online Printing Now Available for NJ Tax Clearance

Dissolve Cancel or Withdraw a Business New Jersey

Customs Tanzania – United Nations

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO: ELS19/2018 C4 Site Information 178- 181 – 4 – A copy of a valid Tax Clearance Certificate issued …

Free guide to withdraw or cancel a foreign Pennsylvania

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO

Tax Exemption, Processing & Verification; Notice of Cut-Off Date for Application of Tobacco Excise Stamps: 181: Invitation For Bid

Form 712 Instructions WordPress.com

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

Bulk Sales Tax Form Department of Taxation and Finance

Form 712 Instructions WordPress.com

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

REV-181 CM (09-13) DEPARTMENT USE ONLY Start Bureau of Compliance PO BOX 280947 Harrisburg PA 17128-0947 APPLICATION FOR TAX CLEARANCE CERTIFICATE 1 NO FILING FEE

Get the Application for Tax Clearance Certificate (REV-181

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO

2011-07-15 · How do I dissolve the llc in PA? In order to obtain the tax clearance certificate, an Application for Tax Clearance Certificate, Form REV-181 must be

Free guide to dissolve a Pennsylvania Corporation

Businesses in Tanzania will now need a tax clearance certificate from Dar traders will need tax certificates to renew certificate from the Tanzania Revenue

Indian regulations for expatriates working in India

2015 Pennsylvania Capital Stock/Foreign Franchise Tax

How to Dissolve an LLC in Pennsylvania Nolo.com

Real Estate Buyer Beware the seller must file form REV-181, the Application for Tax Clearance Seller shall apply for a Bulk Sales Clearance certificate to

Dar traders will need tax certificates to renew licences

103A96E. AWARD AND EXECUTION OF CONTRACT

How do I dissolve the llc in PA? Yahoo Answers

REV-181 CM (09-13) DEPARTMENT USE ONLY Start Bureau of Compliance PO BOX 280947 Harrisburg PA 17128-0947 APPLICATION FOR TAX CLEARANCE CERTIFICATE 1 NO FILING FEE

Get the Application for Tax Clearance Certificate (REV-181

M. Burr Keim Company Pennsylvania Tax Forms

Exemption Certificate Application Certificate is required for tax exemptions. Certificate is the Ministry of Shipping.Out of 181 border check-posts 13 Land

Indian regulations for expatriates working in India

a project of Philadelphia VIP NONPROFIT

How do I apply for a section 116 certificate? This creates a problem since the section 116 certificate is not issued until the tax Dale & Lessmann LLP Office

CONTACT INFORMATION SUBCHAPTER S

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

Form REV-181-I Fillable Instructions For Securing a Tax

Category: Circulars. 2017- DRAFT ESTIMATES OF REVENUE AND EXPENDITURE OF MINISTRIES AND DEPARTMENTS Applying for Tax Clearance Certificate…

ACCOUNTING TECHNICIANS SCHEME OF WEST AFRICA

To apply for a refund of Retail Sales Tax paid on insurance or benefit plan premiums. Application for Vendor Permit RST Clearance Certificate Checklist

Do I Owe a Penalty if I Don’t File a Pennsylvania

Get the Application for Tax Clearance Certificate (REV-181

… Successor liability for state income and franchise taxes. by “The Tax Pennsylvania Form REV-181, Application for Tax Clearance Clearance Certificate …

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

Revenue Ruling No. LT 097 Revenue NSW

Online Printing Now Available for NJ Tax Clearance certificate eliminates the paper application be imposed under the Internal Revenue

Form REV-181 Fillable Application for Tax Clearance

Form Ftb 3571 C2 Request For Estate Income Tax Clearance

person who spends more than 181 Income Tax Clearance Certificate Indian regulations for expatriates working in India Ready for all your queries 5.

How do I dissolve the llc in PA? Yahoo Answers

Category Circulars Ministry of Finance

Hawaii Tax Forms (Alphabetical Listing) Tax Clearance Application (Rev. 2017) General Excise Sublease Deduction Certificate (Rev. 2016)

Category Circulars Ministry of Finance

Step by step instructions for the quickest and cheapest way to dissolve a Pennsylvania Corporation Tax Clearance Certificate, Form REV-181 application is

Category Circulars Ministry of Finance

Do I Owe a Penalty if I Don’t File a Pennsylvania

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

Get the pa exemption certificate rev 1220 9 Exemption Certificate (REV-1220 Harrisbu rg PA 171280947APPLIC ATION FOR TAX CLEARANCE CERTIFICATE1Nam

application for tax clearance certificate-Oyxter Znaleziska

The Kentucky Sales & Use Tax returns (forms 51A102, Service provider fees may apply. Tax Payment Solution Division of Sales and Use Tax Station 67 PO Box 181

How to Obtain Tax Clearance in Pennsylvania Nolo.com

Probate Court Forms

Revenue Ruling No. LT 097 Revenue NSW

Real Estate Buyer Beware the seller must file form REV-181, the Application for Tax Clearance Seller shall apply for a Bulk Sales Clearance certificate to

Wills Information from Toronto lawyers Wagner

15-415 417 Withdrawal Foreign Registration

Pa Exemption Certificate Rev 1220 9 08i Fill Online

The Kentucky Sales & Use Tax returns (forms 51A102, Service provider fees may apply. Tax Payment Solution Division of Sales and Use Tax Station 67 PO Box 181

ACCOUNTING TECHNICIANS SCHEME OF WEST AFRICA

revenue 651 Medicare codes PDF

Dar traders will need tax certificates to renew licences

Successor Liability for State Income and Franchise Taxes Pennsylvania Form REV-181, Application for Tax Clearance Certificate, is used for this

PA-100 PA Enterprise Registration Form and Instructions

The application for Tax Exemption Certificate by department or state enterprise due to lack of set revenue. as fine for duty bond clearance in (181-360)

Successor Liability for State Income and Franchise Taxes

Department of Taxation and Finance. sales must register with the Tax Department and obtain a Certificate of Apply for a Certificate of Authority

Selling Canadian Assets When are s. 116 certificates

Property Taxes City of Pickering

PA-100 PA Enterprise Registration Form and Instructions

Florida Department of Revenue. Home; Taxes; Request for Tax Clearance Letter or Certificate of To receive Certificate of Compliance or a Clearance Letter you

Revenue Ruling No. LT 097 Revenue NSW

Free guide to dissolve a Pennsylvania Corporation

Certificate of Origin (Form 434) Preparation Guide

… phase out the capital stock and foreign franchise tax, and Foreign Franchise Tax, they should file a Form REV-181, Application for Tax Clearance Certificate.

1.3 Myanmar Customs Information Logistics Capacity

Ministry of Finance

Dissolve Cancel or Withdraw a Business New Jersey

Property taxes are the City of Pickering’s main source of revenue in 181/03 (Municipal Tax Certificate if any portion of property taxes remains

PA Capital Stock and Foreign Franchise Tax Expires in

Probate Court Forms

Licenses Department of Revenue

Applying for Tax Clearance Certificate; Paying to register for a Board of Inland Revenue of the Ministry of Finance is responsible for approving all

How do I dissolve the llc in PA? Yahoo Answers

Get the Application for Tax Clearance Certificate (REV-181

Form REV-181-I Fillable Instructions For Securing a Tax

Applying for Tax Clearance Certificate; Paying to register for a Board of Inland Revenue of the Ministry of Finance is responsible for approving all

How to Obtain Tax Clearance in Pennsylvania Nolo.com

To obtain this certificate one should fill out and file the form REV-181. What is a REV-181 form for? This form is a PA application for a Tax Clearance Certificate. The business owner should file this certificate with the court for the dissolution of the business entity. Is an REV-181 form accompanied by other forms?

Form REV-181 Fillable Application for Tax Clearance

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO: ELS19/2018 C4 Site Information 178- 181 – 4 – A copy of a valid Tax Clearance Certificate issued …

Clearance Information uc.pa.gov

Sales & Use Tax Department of Revenue

When is Estate Trustee Obligated to Make Interim

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO: ELS19/2018 C4 Site Information 178- 181 – 4 – A copy of a valid Tax Clearance Certificate issued …

Licenses Department of Revenue

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

Get the Application for Tax Clearance Certificate (REV-181

Online Printing Now Available for NJ Tax Clearance certificate eliminates the paper application be imposed under the Internal Revenue

CRA Says It Will Issue Clearance Certificates for Partial

Department of Taxation Hawaii Tax Forms

Why do I need to Dissolve a Pennsylvania LLC?

A tax clearance letter (known in Pennsylvania as a Application for Tax Clearance Certificate, to request a bulk sale clearance certificate. (Form REV-181 can be

Why do I need to Dissolve a Pennsylvania LLC?

Certificate of Origin (Form 434) Preparation Guide

a project of Philadelphia VIP NONPROFIT

Certificate Of Termination Domestic General Partnership a Form REV-181 (Application for Tax Clearance Certificate) Certificate Of Termination Domestic General

Form Ftb 3571 C2 Request For Estate Income Tax Clearance

To obtain these clearance certificates, a Form REV-181 (Application for Tax Clearance Certificate) must be completed and submitted to both the

Notices gra.gov.gy

M. Burr Keim Company Pennsylvania Tax Forms

* REV-181 Application for Tax Clearance * REV-183 Affidavit of Value Realty Transfer Tax * REV-221 Sales & Use Tax Rate Chart * REV-227 Sales & Use Tax Credit Chart * REV-229 Estate Tax General Information * REV-238 Out of Existence/Withdrawal Affidavit/Corp Tax

Dissolve Cancel or Withdraw a Business New Jersey

Department of Taxation Hawaii Tax Forms

Pennsylvania Tax Information & Forms . Form 100 – Department of Revenue Enterprise Registration Form. Form 181 – Application for Tax Clearance Certificate.

M. Burr Keim Company Pennsylvania Tax Forms

Department of Taxation and Finance. sales must register with the Tax Department and obtain a Certificate of Apply for a Certificate of Authority

How do I dissolve the llc in PA? Yahoo Answers

PA Capital Stock and Foreign Franchise Tax Expires in

Turnover Tax SARS

16 A tax clearance certificate may be obtained by filing an Application for Tax Clearance Certificate Form REV-181. The application may be obtained on Commonwealth of Pennsylvania Department of Revenue website, http://www.revenue.state.pa.us or by calling (717) 783-6055. The fiscal code governing tax clearance certificates may be found at …

revenue 651 Medicare codes PDF

Land tax clearance certificate v Chief Commissioner of State Revenue [2011 to make a profit in the particular tax year for the exemption to apply.

APPLICATION FOR LICENSE 2018 SOLID RECYCLABLE

Applying for Tax Clearance Certificate; Paying to register for a Board of Inland Revenue of the Ministry of Finance is responsible for approving all

When is Estate Trustee Obligated to Make Interim

Form REV-181 Fillable Application for Tax Clearance Certificate (REV-181 181 Fillable Application for Tax Clearance Certificate (REV-181) (all forms

Real Estate Buyer Beware of Bulk Sales – Or You’ll be

Tanzania Revenue Authority Tax Identification Number (TIN) Certificate of a Company 12. Filling fee for the application,

Successor Liability for State Income and Franchise Taxes

A tax clearance letter (known in Pennsylvania as a Application for Tax Clearance Certificate, to request a bulk sale clearance certificate. (Form REV-181 can be

Form REV-181 Fillable Application for Tax Clearance

Stamp duty Revenue NSW

Application For Tax Clearance Certificate {REV-181} This is a Pennsylvania form that can be used for Department Of Revenue within Statewide. Last updated: 4/13/2015

Turnover Tax SARS

a project of Philadelphia VIP NONPROFIT

Ministry of Finance

Tax Exemption, Processing & Verification; Notice of Cut-Off Date for Application of Tobacco Excise Stamps: 181: Invitation For Bid

Revenue Ruling No. LT 097 Revenue NSW

The time it takes to Dissolve a Pennsylvania LLC varies a Tax Clearance Certificate from the of Revenue to process a request for a Tax

Certificate of Origin (Form 434) Preparation Guide

Exemption Certificate Application Certificate is required for tax exemptions. Certificate is the Ministry of Shipping.Out of 181 border check-posts 13 Land

Do I Owe a Penalty if I Don’t File a Pennsylvania

Licenses Department of Revenue

Notices gra.gov.gy

The Kentucky Sales & Use Tax returns (forms 51A102, Service provider fees may apply. Tax Payment Solution Division of Sales and Use Tax Station 67 PO Box 181

When is Estate Trustee Obligated to Make Interim

Probate Court Forms

revenue 651. February 16, 2017 admin No Comments. Application for Tax Clearance Certificate (REV-181) – Revenue.pa.gov.

Clearance Information uc.pa.gov

TOPIC TAX COMPLIANCE ISSUES IN CURRENT ENVIRONMENT

1.3 Myanmar Customs Information Logistics Capacity

Please attach the following information with your application: Certificate to the Minnesota Commissioner of Revenue the Minnesota business tax 176.181 , Subd

Successor Liability for State Income and Franchise Taxes

AIRPORTS COMPANY OF SOUTH AFRICA TENDER NO: ELS19/2018 C4 Site Information 178- 181 – 4 – A copy of a valid Tax Clearance Certificate issued …

a project of Philadelphia VIP NONPROFIT

Licenses Department of Revenue

69 The application for the Tax Clearance Certificate is the 70 responsibility of the bidder and must be submitted directly to the DOTAX 71 or IRS. The approved certificate …

Do I Owe a Penalty if I Don’t File a Pennsylvania

Form 712 Instructions WordPress.com

Dar traders will need tax certificates to renew licences

Please attach the following information with your application: Certificate to the Minnesota Commissioner of Revenue the Minnesota business tax 176.181 , Subd

revenue 651 Medicare codes PDF

PA Capital Stock and Foreign Franchise Tax Expires in

Licenses Department of Revenue

APPLICATION FOR TAX CLEARANCE CERTIFICATE NO FILING FEE 1 (Please submit copy of 501(c) (REV-181) Keywords: Application for Tax Clearance Certificate (REV-181)

How to Obtain Tax Clearance in Pennsylvania Nolo.com

1.3 Bangladesh Customs Information Logistics Capacity

Help with forms and publications Canada.ca