i will teach you to be rich pdf free

I Will Teach You To Be Rich⁚ A Comprehensive Overview

I Will Teach You To Be Rich is a personal finance guide by Ramit Sethi that offers a practical 6-week program designed to help readers take control of their finances, achieve financial freedom, and live a rich life. The book covers budgeting, saving, managing debt, investing, and building an automatic financial system. It emphasizes the importance of conscious spending and shifting one’s mindset from scarcity to abundance.

The Book’s Promise and Target Audience

Ramit Sethi’s “I Will Teach You To Be Rich” is not a typical personal finance book. It doesn’t offer generic advice or preach about sacrifice. Instead, it promises a tangible, actionable path to financial freedom, specifically tailored for a generation often described as “materially ambitious yet financially clueless.” The book’s target audience is individuals between 20 and 35 years old who are navigating early adulthood and seeking a straightforward approach to managing their money effectively. Sethi acknowledges the unique challenges faced by this demographic, including student loan debt, a desire for experiences and travel, and a sense of overwhelm when it comes to financial concepts.

The book’s core promise is to empower readers to take control of their financial lives, build wealth, and enjoy guilt-free spending on the things they truly value. Sethi’s approach is refreshingly non-judgmental and relatable, offering a practical, step-by-step program that can be implemented even with a limited budget and a busy lifestyle. It encourages readers to embrace a mindset of abundance rather than scarcity, believing that financial freedom is attainable for everyone, regardless of their starting point.

The Author⁚ Ramit Sethi

Ramit Sethi is a personal finance expert, entrepreneur, and author, best known for his bestselling book “I Will Teach You To Be Rich.” His unique approach to personal finance has garnered him a loyal following and made him a prominent voice in the financial literacy movement, especially among millennials. Sethi’s background is a blend of academic rigor and real-world experience. He holds a degree from Stanford University and has worked in Silicon Valley, where he honed his skills in business and technology.

Sethi’s writing style is both informative and engaging, blending practical advice with humor and relatable anecdotes. He understands the challenges faced by young adults grappling with student loans, credit card debt, and the pressure to achieve financial stability. His focus on actionable steps and a “no-nonsense” approach resonated with a generation seeking clear guidance and practical solutions. Sethi’s work goes beyond traditional financial advice, addressing the psychological and emotional aspects of money management, encouraging readers to cultivate a healthy relationship with their finances and embrace a mindset of abundance.

Key Principles of the I Will Teach You To Be Rich Methodology

Ramit Sethi’s “I Will Teach You To Be Rich” methodology revolves around a core set of principles designed to empower readers to take control of their finances, break free from debt, and build a solid foundation for financial success. At the heart of this approach is a focus on creating an automated financial system that streamlines money management and reduces the need for constant vigilance; This system encompasses several key components⁚

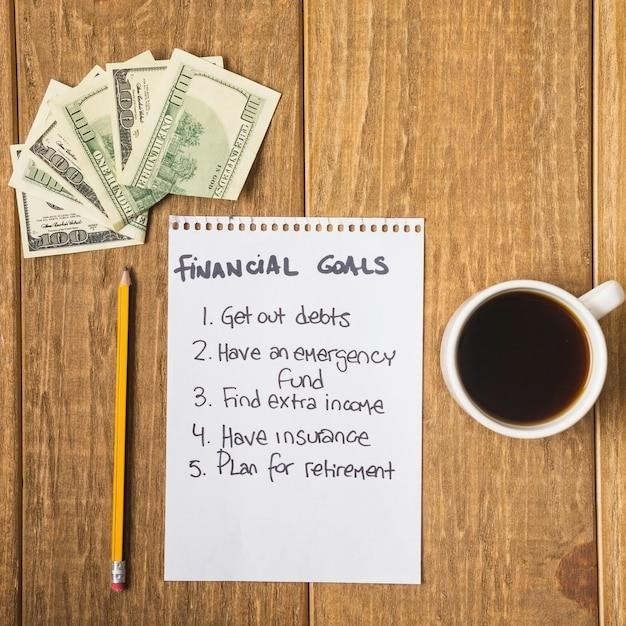

Conscious Spending⁚ Sethi advocates for a conscious approach to spending, encouraging readers to identify and prioritize their spending habits. He emphasizes the importance of allocating funds to “guilt-free” spending categories, allowing individuals to enjoy their money without feeling restricted or guilty.

Strategic Budgeting⁚ Instead of rigid budgeting, Sethi promotes a system that allows for flexibility and prioritizes saving and investing. He encourages readers to define their financial goals and allocate funds accordingly, creating a framework that empowers them to make informed financial decisions.

Debt Management⁚ Sethi offers practical strategies for tackling debt, focusing on creating a plan for paying off high-interest debt and minimizing the burden of student loans. His approach encourages a proactive mindset, emphasizing the importance of taking control of financial obligations rather than being overwhelmed by them.

The 6-Week Program

The heart of “I Will Teach You To Be Rich” lies in its 6-week program, a structured approach designed to guide readers through a comprehensive journey of financial transformation. This program is not a rigid set of rules, but rather a practical framework that encourages self-discovery and empowers individuals to make informed financial choices. The program’s six weeks are divided into distinct phases, each addressing a crucial aspect of personal finance⁚

Week 1⁚ Your Rich Life⁚ This introductory week sets the foundation by encouraging readers to define their personal definition of a “rich life,” outlining their financial goals, and establishing a clear vision for their financial future.

Week 2⁚ Banking and Budgeting⁚ Week 2 focuses on the fundamentals of managing money, guiding readers on choosing the right bank accounts, establishing a simple budgeting system, and understanding the importance of automating savings.

Week 3⁚ Mastering Debt⁚ Week 3 dives into debt management, providing practical strategies for tackling student loan debt, credit card debt, and other financial obligations. Sethi emphasizes the importance of taking control of debt rather than being overwhelmed by it.

Week 4⁚ Investing for Beginners⁚ Week 4 introduces the basics of investing, explaining different investment options and guiding readers on making their first investments. Sethi encourages a gradual and informed approach, emphasizing the importance of understanding investment principles before diving in.

Week 5⁚ The Automatic System⁚ Week 5 focuses on building an automated financial system, streamlining money management and reducing the need for constant monitoring. This system includes setting up automatic payments, automating savings, and establishing recurring investments.

Week 6⁚ Conscious Spending⁚ Week 6 concludes the program by emphasizing the importance of conscious spending and ensuring that financial decisions align with personal values and goals. This involves identifying areas for potential savings and making informed choices that support a fulfilling and financially secure life.

Financial Foundations⁚ Budgeting and Saving

Ramit Sethi emphasizes that the foundation of financial well-being is built on solid budgeting and saving practices. He encourages readers to move beyond the traditional, restrictive budgeting methods and adopt a simpler, more practical approach that aligns with their individual needs and goals. “I Will Teach You To Be Rich” promotes a “conscious spending” strategy, encouraging readers to track their expenses for a short period and identify areas where they can cut back or adjust spending without compromising on their quality of life. Sethi advocates for a “no-guilt” approach to spending, emphasizing the importance of allocating funds for experiences and activities that bring joy and fulfillment.

The book delves into the importance of automating savings, advocating for setting up automatic transfers from checking accounts to savings accounts, ideally on a regular basis. This strategy, Sethi argues, ensures consistent savings growth, even when life gets busy. He also emphasizes the power of setting financial goals, encouraging readers to define specific savings targets, whether it’s for a down payment on a house, a vacation, or a long-term investment. By setting clear goals, readers gain motivation and clarity, making it easier to stay committed to their savings plan.

Sethi’s approach to budgeting and saving emphasizes a balance between financial discipline and enjoying life’s pleasures. He challenges the misconception that living a fulfilling life requires sacrificing financial security, encouraging readers to find a balance that allows them to both achieve their financial goals and indulge in the experiences that matter most to them.

Mastering Debt and Credit

Sethi’s approach to debt management is practical and actionable. He advocates for a proactive strategy that involves understanding your debt obligations, negotiating with creditors, and developing a plan to eliminate debt as quickly as possible. He emphasizes the importance of taking control of your financial situation rather than feeling overwhelmed by debt. He encourages readers to actively negotiate lower interest rates on their existing debt, highlighting the potential for significant savings over time. Sethi’s approach extends beyond simply paying down debt; he emphasizes the importance of building a positive credit history as a crucial step towards financial security. He outlines strategies for improving credit scores, such as using credit cards responsibly, paying bills on time, and keeping credit utilization low.

The book delves into the concept of “good debt” versus “bad debt,” helping readers differentiate between loans that can contribute to long-term financial growth and those that should be avoided. Sethi encourages readers to utilize credit cards strategically, emphasizing the importance of choosing cards with rewards programs that align with their spending habits. He also emphasizes the importance of monitoring credit card balances and making timely payments to avoid accruing interest and late fees. “I Will Teach You To Be Rich” provides a clear framework for understanding the complexities of credit and debt, empowering readers to make informed financial decisions and build a solid foundation for a secure financial future.

Investing for Beginners

Sethi recognizes that investing can feel daunting for beginners. He demystifies the process by providing clear and actionable steps to get started. He encourages readers to start small, emphasizing that even modest investments can compound over time. The book guides readers through the basics of different investment options, including index funds, ETFs, and individual stocks. Sethi simplifies the decision-making process by advocating for a “set it and forget it” approach to investing, suggesting that focusing on long-term growth is more effective than trying to time the market. He provides a practical framework for choosing low-cost index funds that track the performance of the overall market, allowing readers to diversify their investments and minimize risk.

Sethi emphasizes the importance of automating investments, encouraging readers to set up automatic transfers from their checking accounts to their investment accounts. This approach ensures consistent contributions and promotes a disciplined investment strategy. The book also covers the basics of retirement planning, guiding readers through the process of opening a Roth IRA or 401(k) account. Sethi’s approach to investing is designed to empower readers to take control of their financial future, building a portfolio that grows steadily over time. By breaking down complex concepts and providing practical strategies, Sethi helps readers overcome their fear of investing and make informed decisions that support their long-term financial goals.

Building an Automatic Financial System

A central tenet of “I Will Teach You To Be Rich” is the concept of creating an automatic financial system. Sethi advocates for setting up a system that manages your finances effortlessly, freeing you from the constant need to monitor and micromanage your money. He encourages readers to automate their savings, investing, and bill payments to ensure that their financial goals are consistently met. The book provides a step-by-step guide to setting up automatic transfers from your checking account to your savings and investment accounts. This approach allows you to prioritize saving and investing without having to actively think about it, promoting financial discipline and consistent progress towards your goals.

Sethi also recommends automating bill payments, ensuring that bills are paid on time, preventing late fees and maintaining a good credit score. By streamlining these processes, you can eliminate the stress and time associated with managing your finances, allowing you to focus on your passions and goals. An automatic financial system allows you to build wealth passively and consistently, taking the burden off your shoulders and empowering you to make informed financial decisions with confidence. Sethi’s emphasis on automation is a testament to his belief that achieving financial freedom is not about constant vigilance but about creating a system that works for you, allowing you to enjoy the fruits of your labor without the constant worry of managing your finances.

The Importance of Conscious Spending

Ramit Sethi’s “I Will Teach You To Be Rich” emphasizes the importance of conscious spending. He advocates for a shift from mindless consumption to deliberate spending based on your values and priorities. Sethi encourages readers to identify their “guilt-free spending” categories, areas where they genuinely enjoy spending money without feeling remorse. These could include experiences, hobbies, or specific products that bring them joy and fulfillment. He believes that by focusing on these areas, individuals can spend money guilt-free, maximizing their enjoyment and satisfaction.

Sethi also promotes the concept of “spending your way to wealth.” He argues that by carefully allocating your money to experiences that align with your values, you can create a more fulfilling and enriching life without compromising your financial goals. This approach encourages readers to prioritize experiences over material possessions, realizing that true happiness comes from meaningful connections, personal growth, and pursuing passions. By making conscious spending decisions, individuals can create a lifestyle that aligns with their values and fosters a sense of contentment, leading to a more fulfilling and financially secure life.

The Mindset Shift⁚ From Scarcity to Abundance

A fundamental principle in “I Will Teach You To Be Rich” is the shift from a scarcity mindset to an abundance mindset. This means moving away from the belief that resources are limited and embracing the idea that opportunities for wealth and financial freedom are plentiful. Sethi encourages readers to challenge their limiting beliefs about money and recognize that they have the power to create a prosperous life. He argues that by changing the way we think about money, we can unlock new possibilities and create a more positive financial future.

The scarcity mindset often leads to fear, anxiety, and a focus on deprivation. Individuals with this mindset may feel trapped by financial constraints, constantly worried about making ends meet, and hesitant to invest in themselves or their dreams. In contrast, an abundance mindset fosters a sense of possibility, confidence, and a belief in one’s ability to achieve financial goals. By adopting this mindset, individuals become more proactive in their financial planning, embrace opportunities for growth, and feel empowered to create a life of abundance and financial security.